EVERYONE CAN INVEST

The Smart, Simple and Safe Way to Learn Investing

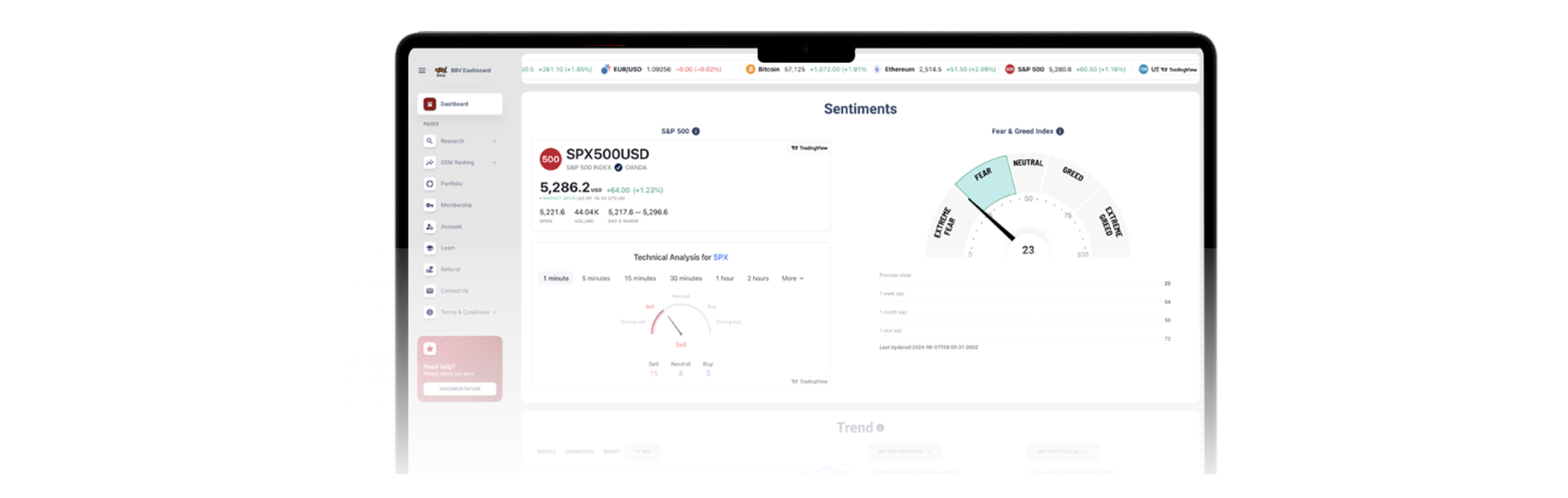

Bull Bear Vector (BBV), the cutting-edge AI-portfolio management system, is set to transform the landscape of investment decision-making in the stocks and options market.

Be Clear,

Conclusive & Confident

Your one-stop-platform to be a better investor

Just Spend 30mins a day!

to have trade ideas to enter new positions

with BBV suggestions

Key Concepts in Stocks and Options Trading

AS FEATURED ON

Why Bull Bear Vector

Powerful and indispensable tool for anyone navigating the financial market

Whether you are a seasoned investor or just starting, BBV’s guidance on long-term and short-term investments empowers you to make informed decisions confidently. With its comprehensive features and unparalleled utility, BBV is the go-to solution for gaining a competitive edge and maximizing returns in the dynamic world of finance.

Why Bull Bear Vector

Our Easy to Learn Content

Bull Bear Vector

Launch, Change, or Advance

your investment journey with us

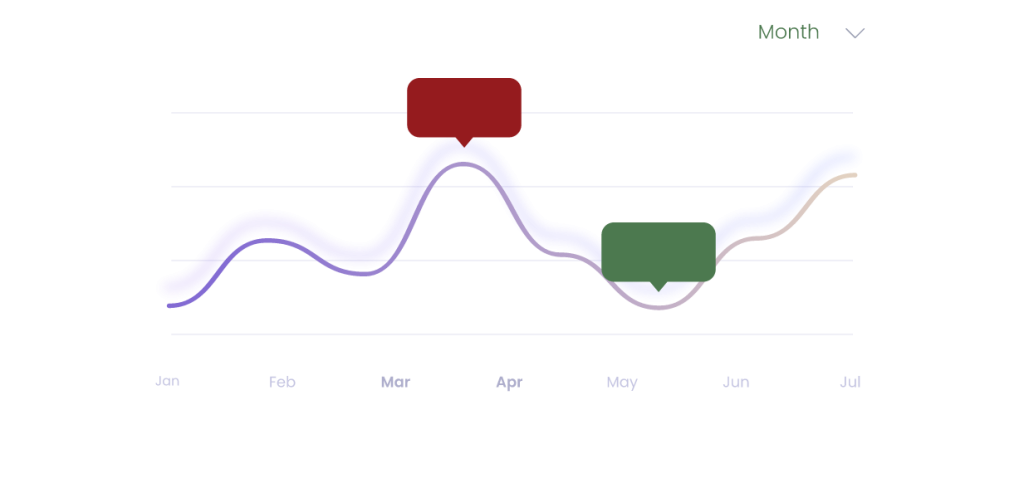

- GEM Ranking

BBV takes the guess work out of trading. Our GEMs ranking will give you our favourite investment opportunities

- Online Community

Join a community of like-minded individuals who share the same goals as you!

- Portfolio Management

BBV will be one-stop portfolio management tool!

- Stock & Options Analysis

With BBV, you’ll be able to see screened financial details of your favourite companies and highest options premiums

- Money Back Guarantee

If BBV isn’t for you, cancel within 30 days and you’ll receive every penny of your membership fee back. No questions asked

- Extensive Education

Explore our extensive education section where you will be able to gain full knowledge on investing

Bull Bear Vector

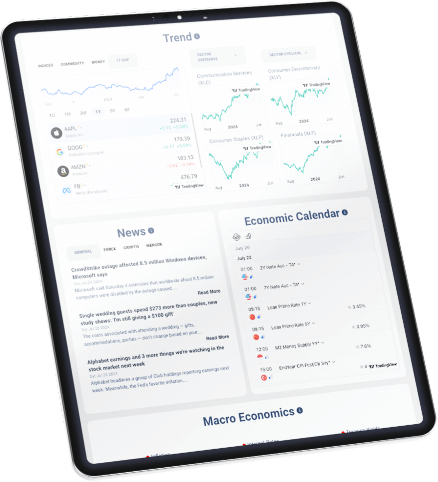

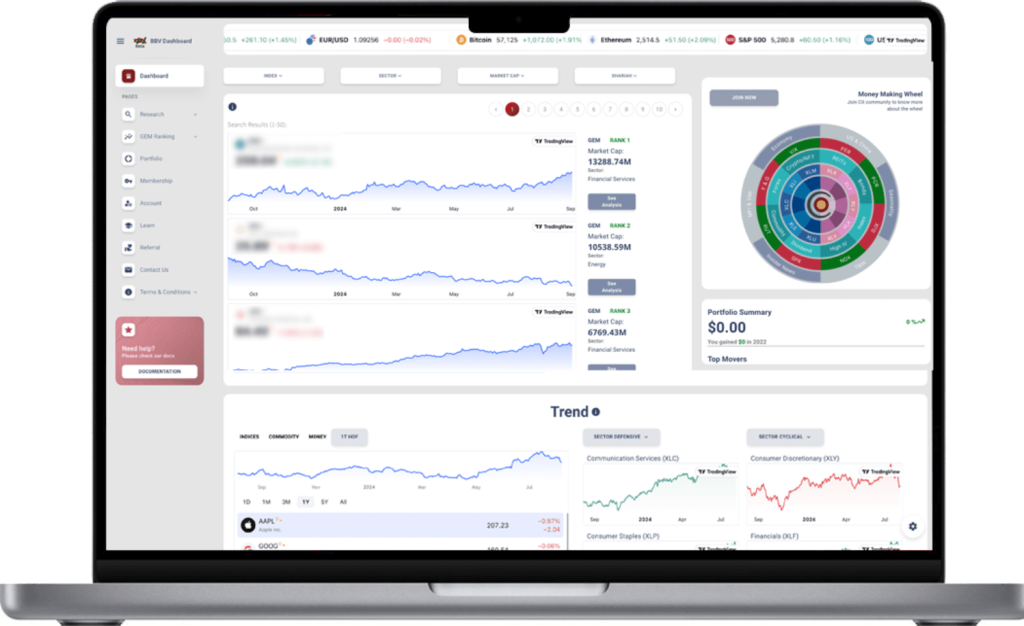

AUTOMATE YOUR PORTFOLIO MANAGEMENT

Our AI Portfolio Management Program

The AI Portfolio Management Program at Bull Bear Vector is designed to revolutionize the way you handle your investments. Leveraging cutting-edge artificial intelligence technology, our program offers a comprehensive suite of tools and resources tailored to both novice and experienced investors.

Whether you’re a seasoned investor looking to streamline your portfolio management or a beginner seeking guidance and education, our AI Portfolio Management Program offers the tools and support you need to achieve your financial goals. Explore the power of AI in investing with Bull Bear Vector today.

Bull Bear Vector

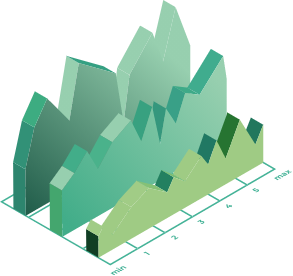

Our proprietary GEM model

Great Return Efficient Cashflow Money Value

This model integrates the key financial ratios automatically, used by 3 Gurus, to give you the convenience, speed and accuracy to generate a comprehensive ranking system that highlights the top-performing stocks based on these crucial factors. By leveraging on investment gurus such as Warren Buffet (Value Investing), Joel Greenblatt (The Magic Formula) and Ray Dalio (All Weather Portfolio), Bull Bear Vector created the GEM Ranking, where users can quickly identify stocks with high potential returns, strong cash flow efficiency, and optimal value for their investments

Our Honest Review

See what our community are saying about us

The BBV ever Expanding Ecosystem

Be part of our growing ecosystem

Core Invest Institute

New to investing? BullBearVector is here to guide you through the fundamentals and help…

The Trend Cafe

New to investing? BullBearVector is here to guide you through the fundamentals and help…

Bull Bear Zap

New to investing? BullBearVector is here to guide you through the fundamentals and help…

Bull Bear World

New to investing? BullBearVector is here to guide you through the fundamentals and help…

The Trend Cafe

New to investing? BullBearVector is here to guide you through the fundamentals and help…

Gold Tree Foundation

New to investing? BullBearVector is here to guide you through the fundamentals and help…

Join Our Community Today

Be a part of our amazing and ever-growing community. Join us in our journey towards financial freedom. You can expect the kinds of benefits that set you up for long-term professional and personal growth

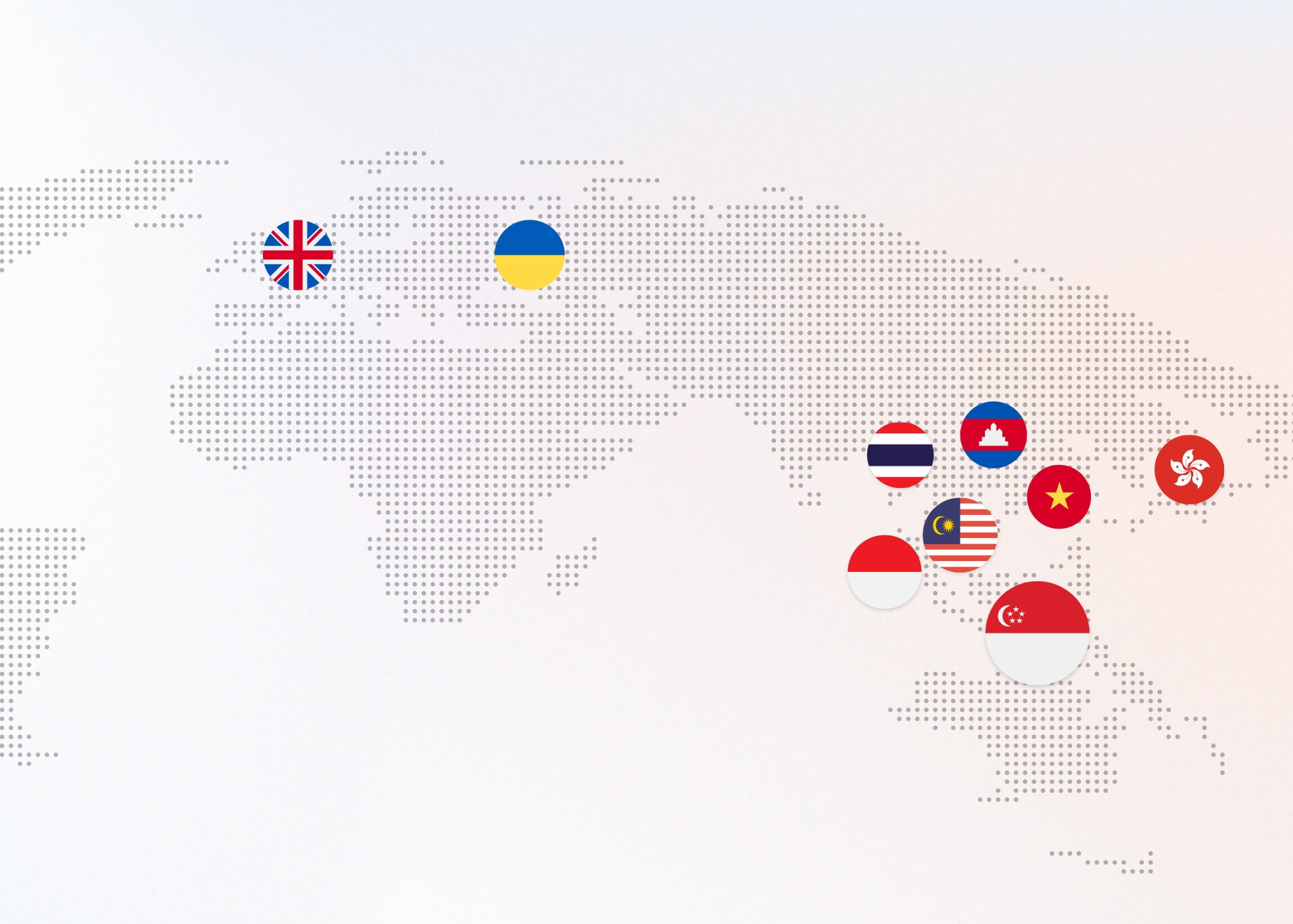

Trusted By Customers from all Nations

Flexible Pricing

Get 20% discount for annual subscription

BBV Basic

Best for new users

FREE

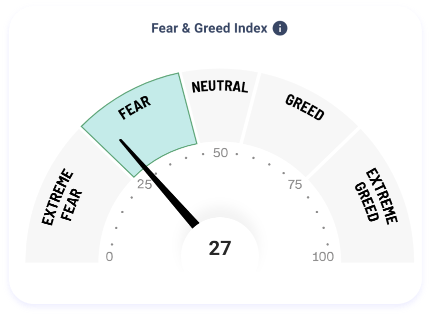

- Basic Dashboard for Market Overview and Sentiments

- User Risk Profile Analysis

- Global Market Analysis

- Global Economic News and Calendar

- Fundamental Analysis of more than 7,000 stocks

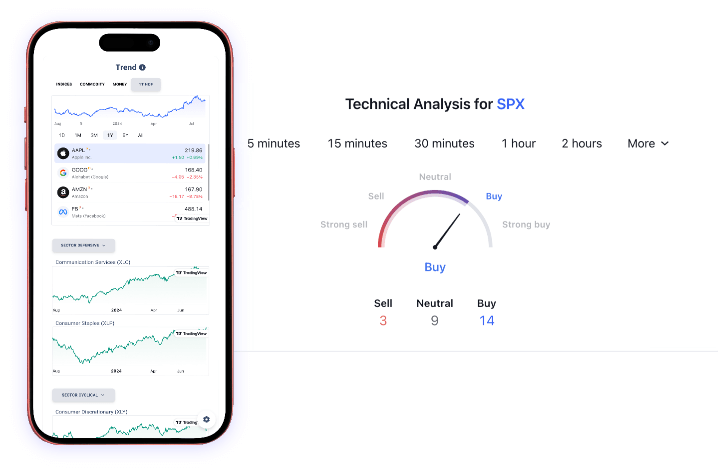

- Technical Analysis with a Sentiment Barometer

- Guru Portfolio Analysis 100% Real Support Community

- 100% Real Support Community

LEARN MORE

BBV Pro+

Best for Options & Stocks

US$ 28/ Month

- All Features from BBV BASIC

- Advanced Dashboard for Market Overview and Sentiments

- Mind Analysis of Macro Economics

- GEM Stock Ranking Scanner

- GEM Options Ranking Scanner

- GEM Traffic Light System

- GEM Stock Ranking by Defensive and Cyclical Sectors

- Automated Stocks Shortlist for Options

- Options Scanner FIS Strategy

- Options Scanner RBS Strategy

- 100% Real Support Community

LEARN MORE

BBV Basic

Best for new users

FREE

- Basic Dashboard for Market Overview and Sentiments

- User Risk Profile Analysis

- Global Market Analysis

- Global Economic News and Calendar

- Fundamental Analysis of more than 7,000 stocks

- Technical Analysis with a Sentiment Barometer

- Guru Portfolio Analysis 100% Real Support Community

- 100% Real Support Community

LEARN MORE

BBV Pro+

Best for Options & Stocks

US$ 35/ Month

- All Features from BBV BASIC

- Advanced Dashboard for Market Overview and Sentiments

- Mind Analysis of Macro Economics

- GEM Stock Ranking Scanner

- GEM Options Ranking Scanner

- GEM Traffic Light System

- GEM Stock Ranking by Defensive and Cyclical Sectors

- Automated Stocks Shortlist for Options

- Options Scanner FIS Strategy

- Options Scanner RBS Strategy

- 100% Real Support Community

LEARN MORE

BBV Basic

Best for new users

FREE

- Basic Dashboard for Market Overview and Sentiments

- User Risk Profile Analysis

- Global Market Analysis

- Global Economic News and Calendar

- Fundamental Analysis of more than 7,000 stocks

- Technical Analysis with a Sentiment Barometer

- Guru Portfolio Analysis 100% Real Support Community

- 100% Real Support Community

LEARN MORE

BBV Pro+

Best for Options & Stocks

US$ 28/ Month

- All Features from BBV BASIC

- Advanced Dashboard for Market Overview and Sentiments

- Mind Analysis of Macro Economics

- GEM Stock Ranking Scanner

- GEM Options Ranking Scanner

- GEM Traffic Light System

- GEM Stock Ranking by Defensive and Cyclical Sectors

- Automated Stocks Shortlist for Options

- Options Scanner FIS Strategy

- Options Scanner RBS Strategy

- 100% Real Support Community

LEARN MORE

BBV Basic

Best for new users

FREE

- Basic Dashboard for Market Overview and Sentiments

- User Risk Profile Analysis

- Global Market Analysis

- Global Economic News and Calendar

- Fundamental Analysis of more than 7,000 stocks

- Technical Analysis with a Sentiment Barometer

- Guru Portfolio Analysis 100% Real Support Community

- 100% Real Support Community

LEARN MORE

BBV Pro+

Best for Options & Stocks

US$ 35/ Month

- All Features from BBV BASIC

- Advanced Dashboard for Market Overview and Sentiments

- Mind Analysis of Macro Economics

- GEM Stock Ranking Scanner

- GEM Options Ranking Scanner

- GEM Traffic Light System

- GEM Stock Ranking by Defensive and Cyclical Sectors

- Automated Stocks Shortlist for Options

- Options Scanner FIS Strategy

- Options Scanner RBS Strategy

- 100% Real Support Community

LEARN MORE

Take an Insight, Then Leap

The Frequently Asked Questions

Why Should I use Bull Bear Vector?

Bull Bear Vector (BBV) is a powerful and indispensable tool for anyone navigating the complexities of the financial market. With its user-friendly dashboard, BBV provides invaluable insights into the current market situation, allowing users to analyze company profiles and earnings effortlessly. For active traders, BBV’s option ranking function offers a unique advantage by identifying companies with exceptional potential, ensuring safer investment opportunities below 1500. Whether you are a seasoned investor or just starting, BBV’s guidance on long-term and short-term investments empowers you to make informed decisions confidently. With its comprehensive features and unparalleled utility, BBV is the go-to solution for gaining a competitive edge and maximizing returns in the dynamic world of finance.

How can I start investing?

Embarking on your investment journey is an exciting and rewarding endeavor. To start investing, follow these essential steps. First, educate yourself about different investment options and risk levels. Understand stocks, bonds, mutual funds, real estate, and other financial instruments. Next, create a budget and set aside an amount you can comfortably invest regularly. Establish an emergency fund to cover unexpected expenses. Then, open an investment account with a reputable brokerage or financial institution. Consider factors like fees, customer support, and available investment options. Diversify your investments across various assets to spread risk and potential returns. Stay focused on long-term goals and avoid impulsive decisions based on short-term market fluctuations. Finally, keep learning and adjusting your investment strategy as your financial situation evolves. Remember, patience, discipline, and a long-term outlook are key to successful investing.

Is Investing Safe?

Investing can be both rewarding and risky, and the safety of investments largely depends on various factors. While certain investment options, such as government bonds and savings accounts, are generally considered safer due to their lower risk and predictable returns, they may offer lower potential for significant gains. On the other hand, investments in stocks, real estate, or startup ventures have the potential for higher returns but come with higher levels of risk. Diversification, spreading investments across different assets, is a common strategy to mitigate risk. However, it’s crucial to remember that all investments carry some degree of risk, and no investment is entirely risk-free. Proper research, understanding of risk tolerance, and a long-term perspective are essential in making informed and safer investment decisions. Consulting with a financial advisor can also help individuals develop a well-balanced and suitable investment plan based on their unique financial goals and circumstances.