- Home

- Stock Market

- Navigating Large-Cap Stocks

Navigating Large-Cap Stocks

Introduction: Large-cap stocks, representing some of the most prominent companies in the world, have a strong presence in global markets. In this article, we’ll explore who may buy these stocks, when to consider them, reveal the top 3 large-cap stock market picks, and provide compelling reasons for investors to consider including large-cap stocks in their portfolios.

Who May Buy Large-Cap Stocks?

Income-Oriented Investors: Large-cap stocks often pay dividends, making them an attractive option for investors seeking a regular income stream. These companies are generally more stable and likely to provide consistent dividend payments.

Risk-Averse Investors: Large-cap stocks are typically less volatile than small or mid-cap counterparts. Investors who prioritize stability and lower risk may find large-cap stocks appealing.

Long-Term Investors: Large-cap companies have a proven track record of resilience and longevity. Investors with a long-term horizon can benefit from the potential for sustained growth and stability.

- When to Buy Large-Cap Stocks?

- Market Conditions: Large-cap stocks can be an excellent choice during periods of economic uncertainty or market volatility. They often exhibit resilience and can act as a defensive component in a diversified portfolio.

- Diversification Needs: Consider investing in large-cap stocks as part of a well-balanced portfolio. They can help mitigate risk and provide stability when other asset classes experience turbulence.

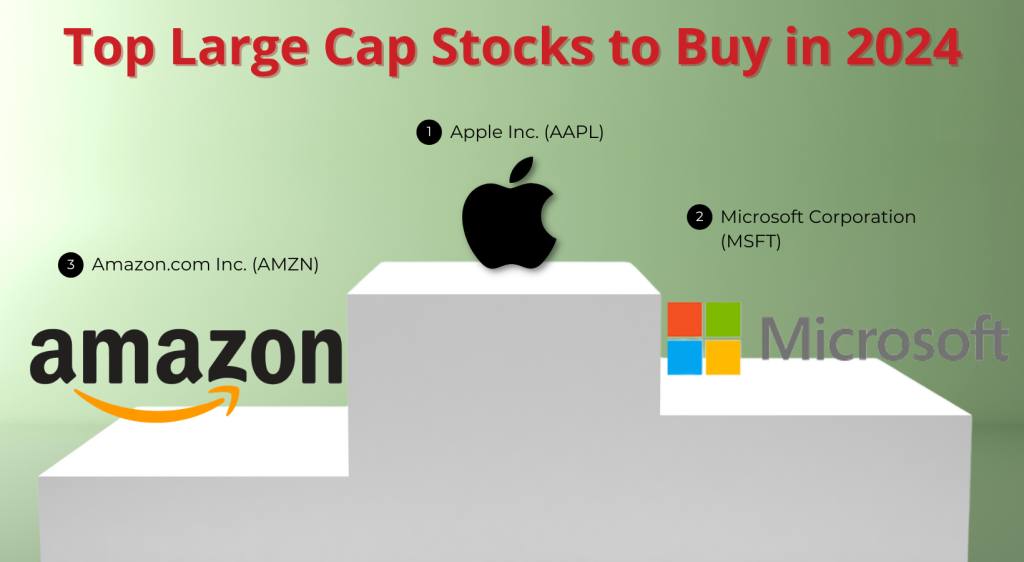

- Top 3 Large-Cap Stock Market Picks:

- Apple Inc. (AAPL): Apple is one of the world's most valuable companies, known for its innovative technology products and services. With a strong balance sheet, a loyal customer base, and a history of consistent growth, Apple is a top choice for large-cap investors.

- Microsoft Corporation (MSFT): Microsoft is a leader in the technology sector, offering a wide range of software, cloud, and computing services. Its strong financials, dividend history, and continuous innovation make it a solid investment option.

- Amazon.com Inc. (AMZN): Amazon is a dominant force in e-commerce, cloud computing, and digital content. The company's vast market reach, continued expansion, and diverse revenue streams make it a compelling large-cap stock.

- Stability and Consistency: Large-cap stocks are known for their financial stability and consistent performance. They are less susceptible to market shocks and economic downturns, making them a reliable choice for risk-averse investors.

- Dividend Income: Many large-cap companies pay dividends, providing investors with a regular income stream. This income can be especially valuable for retirees or those looking to supplement their earnings.

- Global Presence: Large-cap stocks often have a global presence and exposure to diverse markets. This international diversification can help spread risk and provide opportunities for growth in various economic conditions.

- Institutional Support: Institutional investors, such as mutual funds and pension funds, often invest in large-cap stocks. Their extensive research and resources can contribute to the long-term success of these companies.

This article was written by:

Benjamin the Bull

I write about companies that fascinate me and that also offers investors with potential as a long-term position. I primarily focus on the energy and industrial sector but every now and again venture out to other sectors too.

Bull Bear Vector’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Bullbearvector as a whole. Bullbearvector is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body