As the digital revolution continues to reshape traditional financial landscapes, cryptocurrency stocks have emerged as a popular avenue for investors seeking exposure to the crypto market. While some investors prefer direct ownership of digital assets, others find comfort in investing in companies that operate within the cryptocurrency space. In this article, we’ll explore five cryptocurrency stocks worth considering for investment and provide insights for newcomers on how to dip their toes into this dynamic market.

As the digital revolution continues to reshape traditional financial landscapes, cryptocurrency stocks have emerged as a popular avenue for investors seeking exposure to the crypto market. While some investors prefer direct ownership of digital assets, others find comfort in investing in companies that operate within the cryptocurrency space. In this article, we’ll explore five cryptocurrency stocks worth considering for investment and provide insights for newcomers on how to dip their toes into this dynamic market.

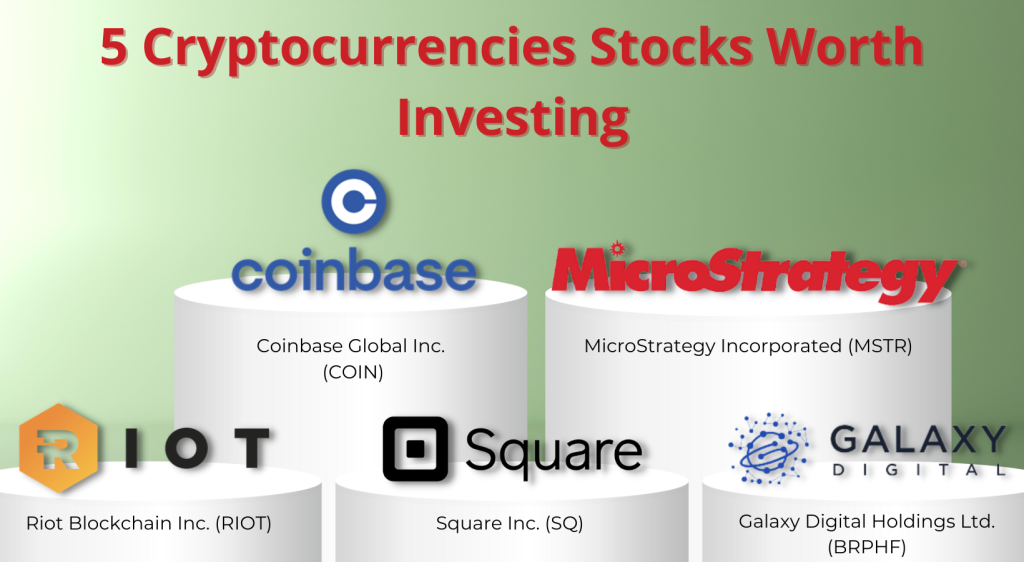

- Coinbase Global Inc. (COIN): The Crypto Exchange Pioneer: Coinbase, one of the most recognizable names in the crypto industry, is a leading cryptocurrency exchange. The platform allows users to buy, sell, and store various cryptocurrencies, making it a convenient entry point for those new to the market. Coinbase’s stock, listed as COIN, offers investors exposure to the growing user base of the platform and the increasing adoption of cryptocurrencies.

- MicroStrategy Incorporated (MSTR): Bitcoin as Corporate Treasury: MicroStrategy is a business intelligence company that made headlines by adopting Bitcoin as a primary treasury reserve asset. The company’s strategic move to hold Bitcoin on its balance sheet has positioned it as a unique investment opportunity for those seeking exposure to the flagship cryptocurrency. MicroStrategy’s stock, MSTR, is seen by some as a proxy for indirect Bitcoin exposure within the traditional stock market.

- Riot Blockchain Inc. (RIOT): Mining for Digital Gold: Riot Blockchain is a cryptocurrency mining company that focuses on the production of Bitcoin. Mining involves solving complex mathematical problems to validate transactions on the blockchain and, in return, miners are rewarded with new Bitcoins. As the demand for Bitcoin grows, companies like Riot Blockchain stand to benefit. Investing in RIOT provides exposure to the potential profits from Bitcoin mining operations.

- Square Inc. (SQ): Fintech Giant Embracing Crypto: Square, led by Twitter CEO Jack Dorsey, is a fintech company that has integrated cryptocurrency into its suite of services. The company’s mobile payment app, Cash App, allows users to buy and sell Bitcoin. Square’s stock, listed as SQ, provides investors with exposure to a diversified fintech company that’s actively participating in the cryptocurrency space, aligning with the growing trend of mainstream financial institutions adopting digital assets.

- Galaxy Digital Holdings Ltd. (BRPHF): A Comprehensive Crypto Investment Firm: Galaxy Digital, founded by former hedge fund manager Mike Novogratz, is a diversified financial services firm focused on cryptocurrency and blockchain technology. The company is involved in various activities, including trading, asset management, and investment banking within the crypto space. Galaxy Digital’s stock, listed as BRPHF, offers investors exposure to a range of crypto-related activities through a single investment.

Cryptocurrency stocks are accessible to a broad range of investors, including retail investors, institutional investors, and individuals with traditional brokerage acc

How Can Someone New to Investing Get Started?

Begin by educating yourself about the basics of investing, the stock market, and cryptocurrency. Understand the fundamentals of blockchain technology and the business models of the companies you’re interested in.

Select a reputable brokerage platform to start investing in stocks. Platforms like Robinhood, TD Ameritrade, or Fidelity provide easy access to a wide range of stocks, including those in the cryptocurrency space.

As with any investment, diversification is key. Consider spreading your investments across different cryptocurrency stocks to reduce risk.

Keep yourself informed about market trends, regulatory developments, and news related to the cryptocurrency industry. The market can be dynamic, and staying informed is crucial for making informed investment decisions.

If you’re new to investing, consider starting with a small investment and gradually increasing your exposure as you become more comfortable with the market dynamics.

Risk and Rewards in Investing Into Cryptocurrency

- High Potential Returns: Cryptocurrencies have demonstrated the potential for substantial returns, often outperforming traditional asset classes. This can be attributed to their innovative technology and growing acceptance.

- Innovation and Technology: Investing in cryptocurrency is often seen as investing in the future of technology, particularly blockchain. This technology has the potential to revolutionize various industries.

- Diversification: Cryptocurrency can offer diversification to an investment portfolio. Its market movements are often uncorrelated with traditional asset classes, reducing overall portfolio risk.

- 24/7 Market: Unlike traditional markets, the cryptocurrency market operates 24/7, offering continuous trading opportunities.

- Decentralization: Many cryptocurrencies are decentralized, reducing the influence of central authorities and potentially lowering the risk of censorship or seizure.

- Volatility: Cryptocurrencies are notoriously volatile, with prices subject to large swings in short periods. This can lead to significant losses.

- Regulatory Risk: The regulatory environment for cryptocurrencies is still evolving. Changes in regulations can have a profound impact on the value and legality of certain cryptocurrencies.

- Security Risks: Investing in cryptocurrencies involves risks like hacking, fraud, and loss of access to wallets. These risks can lead to the loss of investment.

- Market Immaturity: The cryptocurrency market is relatively new and less mature than traditional financial markets, leading to issues with liquidity, market manipulation, and lack of reliable historical data.

-

Technological Risks: Issues like network problems, scalability issues, or technological flaws in a cryptocurrency can impact its value and functionality.

The Crypto Whale

A “crypto whale” refers to an individual or an entity that holds a large amount of a particular cryptocurrency. These holders have enough of the currency to potentially influence market prices through their trading activities. Understanding the role and impact of crypto whales involves examining their characteristics, strategies, and influence on the cryptocurrency market.

Characteristics of Crypto Whales

- Large Holdings: Crypto whales possess a significant portion of a cryptocurrency’s total circulating supply. This can range from thousands to even millions of coins or tokens.

- Anonymity: Many crypto whales prefer to remain anonymous, making it challenging to identify their influence or intentions.

- Diverse Types: They can be early adopters, wealthy individuals, large-scale investors, or even organizations such as hedge funds, investment firms, or corporations.

- Strategic Trading: Whales often trade strategically, using their substantial holdings to influence market dynamics.

Strategies of Crypto Whales

- Market Manipulation: Some whales may engage in market manipulation, such as creating large buy or sell walls to influence prices in a desired direction.

- Accumulation and Distribution: Whales may accumulate more of a cryptocurrency when prices are low and distribute or sell when prices are high.

- Influencing Sentiment: Large transactions by whales can influence market sentiment, often causing smaller investors to react in panic buying or selling.

- Quiet Trading: To avoid market disruption, whales may execute trades in smaller quantities over time or utilize over-the-counter (OTC) trading.

The Crypto Winter

The term “crypto winter” refers to a period in the cryptocurrency market characterized by prolonged, significant declines in the values of cryptocurrencies. It’s akin to a bear market in traditional finance but specifically for the crypto sector. Understanding the dynamics of a crypto winter involves exploring its causes, impacts, and potential strategies for investors.

Impacts of Crypto Winter

- Declining Asset Values: The most direct impact is the substantial decline in the value of most cryptocurrencies.

- Reduced Funding for Projects: A decline in market values can lead to reduced funding and investment in crypto projects, slowing the pace of innovation and growth in the sector.

- Consolidation: Weaker projects or companies may fail, leading to consolidation in the industry.

- Changes in Investor Behavior: Investors may become more risk-averse, prioritizing projects with stronger fundamentals and real-world applications.

Strategies During Crypto Winter

- Long-Term Perspective: Investors may need to adopt a long-term view, acknowledging that recovery might take time.

- Diversification: Diversifying holdings across different asset classes can mitigate risk.

- Research and Due Diligence: Investing in projects with strong fundamentals, real-world use cases, and sound management becomes even more important.

- Risk Management: Implementing strict risk management strategies, like setting stop-loss limits, can help protect against large losses.

- Capitalizing on Opportunities: For some investors, a crypto winter may present buying opportunities at lower valuations.

Investing in cryptocurrency stocks provides a unique opportunity for investors to participate in the digital revolution through established and emerging companies in the crypto space. By carefully researching and understanding the businesses behind the stocks, diversifying one’s portfolio, and staying informed about market trends, even those new to investing can confidently navigate the world of cryptocurrency stocks. Remember, while the potential for significant returns exists, it’s essential to approach these investments with diligence and a long-term perspective

This article was written by:

Benjamin the Bull

I write about companies that fascinate me and that also offers investors with potential as a long-term position. I primarily focus on the energy and industrial sector but every now and again venture out to other sectors too.

Bull Bear Vector’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Bullbearvector as a whole. Bullbearvector is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body