Have you ever pondered the concept of energy stocks and their impact on your present, past, and future? Considering that energy is integral to virtually every aspect of our lives — from fueling our cars and powering lights to cooking meals and running air conditioners — understanding energy stocks becomes essential. Energy, indeed, plays a crucial role in shaping our daily experiences and holds significance for both current and future scenarios.

The energy industry is the backbone of global economies, driving progress and powering everyday life. In this article, we will delve into the world of energy stocks, exploring the vast array of activities within the sector and the compelling reasons why investors should consider including them in their portfolios in 2023.

The Energy Industry: Activities and Sub-Sectors The energy industry is a multifaceted sector, comprising various activities:

These companies are responsible for the exploration, extraction, and production of oil and natural gas. They often operate on a global scale, seeking new reserves and optimizing existing ones to meet energy demand.

Businesses in this sub-sector focus on harnessing clean and sustainable energy sources, such as solar, wind, and hydropower. As the world shifts towards more environmentally friendly options, renewable energy companies are at the forefront of innovation.

This sub-sector deals with the transportation and storage of energy resources. Companies within this category maintain and expand the necessary infrastructure, including pipelines, terminals, and storage facilities, to ensure a continuous energy supply.

Firms involved in nuclear energy are responsible for generating power through nuclear reactors. Nuclear energy has long been a source of clean and efficient electricity.

Who May Buy Energy Stocks? Understanding the target audience for energy stocks is crucial. Here are the key investor profiles:

-

- Income-Oriented Investors: Energy stocks are often associated with steady dividend payments, making them an attractive choice for income-oriented investors seeking regular income streams and financial stability.

- Value Investors: Those with a knack for identifying undervalued stocks may find opportunities in the energy sector, particularly during industry downturns. These stocks can provide significant value for investors.

- Long-Term Investors: The energy sector offers not only current investment prospects but also long-term growth potential. Investors with an extended investment horizon can benefit from the sector’s cyclical nature and global demand.

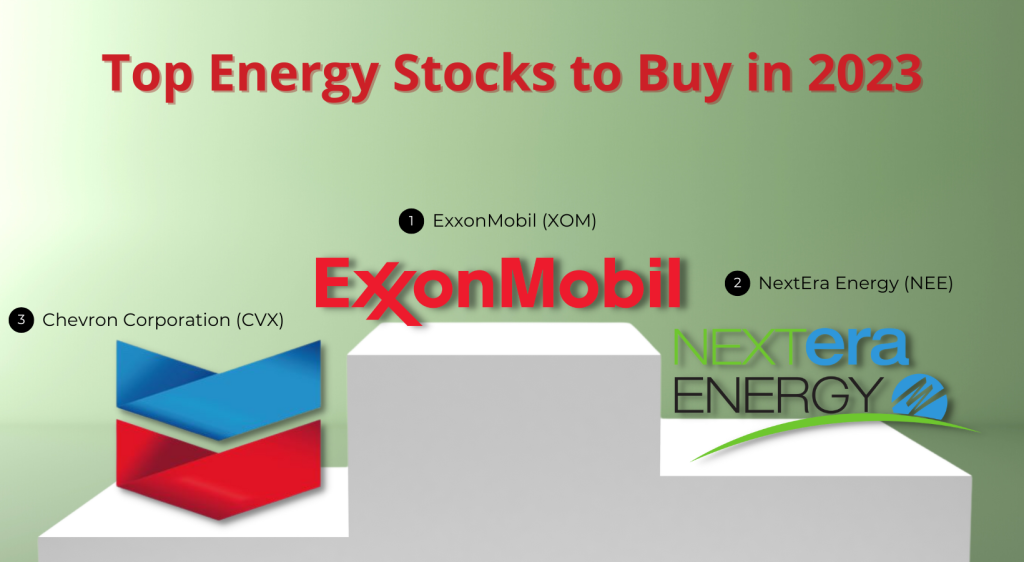

Best Energy Stocks in the Industry for 2023 In 2023, certain energy stocks stand out as promising investment opportunities:

- ExxonMobil (XOM): As a major player in the oil and gas sector, ExxonMobil boasts a storied history of dividends and global operations. Its wide-reaching operations and commitment to long-term value make it a top choice for investors.

- NextEra Energy (NEE): NextEra Energy is a leader in the renewable energy space, making it well-positioned for the global shift towards cleaner energy sources. With a forward-thinking approach, it’s a standout choice for investors focused on sustainability.

- Chevron Corporation (CVX): Chevron is a global energy giant involved in both traditional and renewable energy initiatives. Its diverse portfolio and commitment to transitioning to cleaner energy sources make it an appealing choice for 2023.

- Dividend Income: Many energy companies are known for paying attractive dividends, making them a source of regular income for investors, particularly income-oriented ones.

- Global Demand: The energy sector is characterized by continuous and growing global demand. As the world population increases and economies expand, the need for energy remains on an upward trajectory, offering long-term growth prospects.

- Sector Diversification: Energy stocks provide a means of diversifying an investment portfolio. They offer stability and returns that are often independent of other industries, which can help mitigate risk during market fluctuations.

- Renewable Energy Growth: With the world transitioning towards cleaner and more sustainable energy sources, the renewable energy segment within the sector presents significant growth potential. Investing in companies at the forefront of renewable energy innovation can be particularly lucrative.

source: https://www.fidelity.com/learning-center/trading-investing/markets-sectors/intro-sector-rotation-strats

Energy stocks play a pivotal role in sector rotation as investors adjust portfolios based on economic cycles. During economic expansion, rising energy demand boosts the performance of energy stocks, leading to increased allocations. Conversely, in economic contractions, reduced demand prompts investors to reallocate assets away from the energy sector. Geopolitical events, commodity price trends, and regulatory changes also influence energy stocks’ attractiveness, impacting sector rotation decisions. This strategic adjustment ensures portfolios align with prevailing economic conditions, optimizing risk and return profiles across diverse sectors within the investment landscape.

Energy prices are influenced by a combination of factors, and various entities play a role in shaping the dynamics of the energy market. Here are key elements and stakeholders that affect energy prices:

-

Supply and Demand:

- The fundamental economic principle of supply and demand is a primary driver of energy prices. When demand for energy exceeds supply, prices tend to rise, and vice versa.

-

Global Geopolitical Events:

- Political instability, conflicts, and geopolitical events in major energy-producing regions can impact the global energy market. Disruptions in the supply chain due to geopolitical tensions can lead to fluctuations in energy prices.

-

Natural Disasters:

- Natural disasters such as hurricanes, earthquakes, or floods can disrupt energy production, distribution, and infrastructure, affecting the availability of energy resources and contributing to price volatility.

-

OPEC and Oil-producing Countries:

- The Organization of the Petroleum Exporting Countries (OPEC) and other major oil-producing nations have a significant influence on oil prices. Production decisions and agreements among these countries can impact global oil supply and, consequently, prices.

-

Technology and Innovation:

- Advances in technology, especially in renewable energy and extraction techniques (such as fracking), can influence the overall energy market. Increased efficiency and innovation may impact supply and demand dynamics.

-

Currency Exchange Rates:

- Energy prices are often denominated in U.S. dollars. Changes in currency exchange rates can affect the purchasing power of countries and impact the affordability of energy resources, leading to price adjustments.

-

Economic Indicators:

- Economic conditions, such as GDP growth, unemployment rates, and consumer spending, can impact energy demand. During economic downturns, there is often reduced demand for energy, affecting prices.

-

Government Policies and Regulations:

- Government policies, including taxation, subsidies, and environmental regulations, can influence the energy market. For example, incentives for renewable energy may impact the demand for traditional energy sources.

-

Speculation and Financial Markets:

- Financial markets and speculative activities can contribute to short-term fluctuations in energy prices. Traders and investors react to market sentiment, economic indicators, and geopolitical news, impacting price movements.

-

Climate and Weather Conditions:

- Weather patterns, seasonal variations, and climate conditions can affect energy consumption. For instance, extreme weather events can lead to increased demand for heating or cooling, influencing prices.

Understanding the intricate interplay of these factors is crucial for analyzing and predicting energy price movements. It’s also worth noting that the energy market is dynamic, and the influence of these factors can change over time.

Conclusion: Energy stocks represent a vital and multifaceted sector within the global economy. By understanding the different sub-sectors and activities within the industry, recognizing who may find energy stocks appealing, understanding when to invest, exploring the best energy stocks for 2023, and appreciating why they should be included in a portfolio, investors can make informed decisions. Energy stocks offer not only the potential for dividend income but also long-term growth, stability, and a prominent role in the transition to cleaner and more sustainable energy sources. For those looking to power their investments, the energy sector remains a compelling choice in 2023 and beyond.

Want to learn more about energy and utilities? Watch this video below for free!

This article was written by:

Benjamin the Bull

I write about companies that fascinate me and that also offers investors with potential as a long-term position. I primarily focus on the energy and industrial sector but every now and again venture out to other sectors too.

Bull Bear Vector’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Bullbearvector as a whole. Bullbearvector is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body