What Are Consumer Discretionary Stocks?

Consumer discretionary stocks represent companies whose products or services are considered non-essential, often driven by consumer preferences and disposable income. These stocks can encompass a wide range of industries, including retail, entertainment, travel, and more

Who May Buy Consumer Discretionary Stocks

- Growth-Oriented Investors: Those seeking high growth potential may be attracted to consumer discretionary stocks. These companies tend to benefit from economic upturns and consumer sentiment, leading to potential capital appreciation.

- Income-Oriented Investors: Some consumer discretionary stocks pay dividends, making them suitable for income-oriented investors looking for a mix of capital gains and dividend income.

-

Risk-Tolerant Investors: The consumer discretionary sector can be more volatile, making it suitable for investors with higher risk tolerance. The potential for substantial returns can outweigh the risks for some.

When to Buy Consumer Discretionary Stocks

- Economic Expansion: Consider buying consumer discretionary stocks during economic expansions when consumer spending tends to rise. Strong consumer sentiment and employment levels can boost these companies' performance.

- Market Dips and Corrections: Look for buying opportunities during market downturns when consumer discretionary stocks may be undervalued. Timing the market is challenging, but purchasing during dips can enhance potential returns.

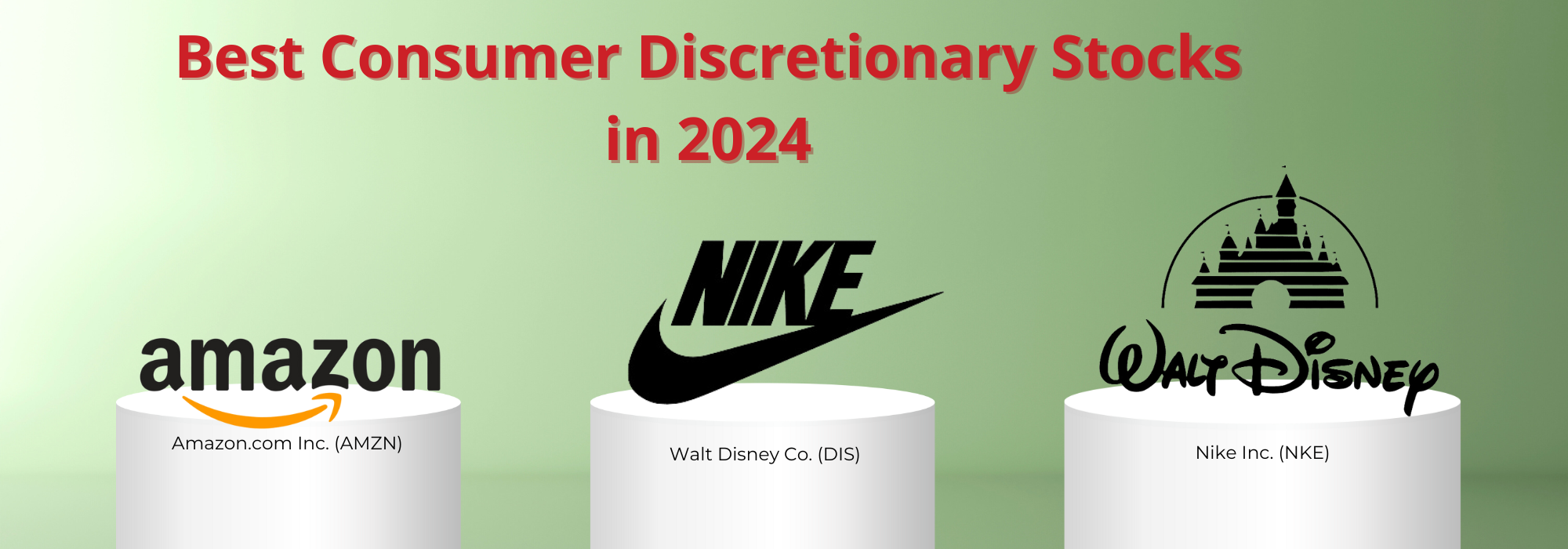

- Amazon.com Inc. (AMZN): Amazon is a leader in e-commerce, cloud computing, and digital content. Its diverse revenue streams, market dominance, and continuous innovation make it a compelling pick in the consumer discretionary sector for 2024.

- Walt Disney Co. (DIS): Disney is a global entertainment powerhouse with a vast portfolio of beloved franchises. The reopening of theme parks and growth in streaming services position Disney as an attractive choice in 2023.

- Nike Inc. (NKE): Nike is a renowned global sports apparel and footwear company. As sports and fitness trends continue to grow, Nike's innovative products and global reach make it a top contender in the consumer discretionary sector.

Why Invest in Consumer Discretionary Stocks?

- Economic Sensitivity: Consumer discretionary stocks often thrive during periods of economic growth when consumer spending is robust. Investing in this sector allows you to capitalize on economic expansion.

- Diverse Opportunities: The consumer discretionary sector encompasses a wide range of industries, from retail to entertainment. Diversification within the sector can help manage risk while offering exposure to various growth opportunities.

- Innovation and Trends: Consumer preferences constantly evolve. Investing in this sector allows you to benefit from companies at the forefront of innovation and changing trends, potentially leading to significant gains.

- Long-Term Growth: Many consumer discretionary stocks have a history of long-term growth. By investing in well-established companies with strong brand recognition, you can potentially enjoy stable returns over time.

Consumer discretionary stocks offer a dynamic and exciting sector for investors looking for growth opportunities. By understanding what they are, and who may benefit from them, recognizing when to consider investing, exploring the best picks for 2023, and understanding why to invest in this sector, you can make informed decisions to potentially boost your investment portfolio. The consumer discretionary sector’s resilience and potential for substantial returns continue to make it an attractive option for many investors.

Want to learn more? Watch this video!

This article was written by:

Benjamin the Bull

I write about companies that fascinate me and that also offers investors with potential as a long-term position. I primarily focus on the energy and industrial sector but every now and again venture out to other sectors too.

Bull Bear Vector’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Bullbearvector as a whole. Bullbearvector is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body