Remember the days when a hearty plate of chicken rice in our favourite hawker centre was only $2.50? Fast forward to now, and you’ll be shelling out close to $10.0 for that same plate! This jump in price isn’t just about the chicken or the rice, it’s about something bigger – inflation. The Consumer Price Index (CPI) is what gives us the lowdown on this. It’s like the kiasu way of tracking how prices go up over time for everyday stuff. So, when you hear your kopi kakis grumbling about how expensive things are getting in our little red dot, it’s the CPI and inflation making themselves felt in our wallets!

What is CPI?

The U.S.’s CPI, or the Consumer Price Index is a key index that reflects and monitors inflation levels in America as it changes over time; an important indicator of economic activities to reflect cost adjustments for various products and services across different sectors within this country’s economy. The difference in the CPI during a particular period represents an inflation rate.

The U.S Bureau of Labor Statistics monthly reports on the CPI, shows a table detailing price changes in different goods and services since last month and year to date.

Besides the core CPI data, there is a type of inflation called “core CPIinflation”. This version provides a more uniform vision of inflation by eliminating food and energy prices. The rationale for this omission is that the prices of these products may vary significantly and irregularly from one month to another as a result of factors completely irrelevant to consumer demand.

What Is the Latest CPI Inflation Reading?

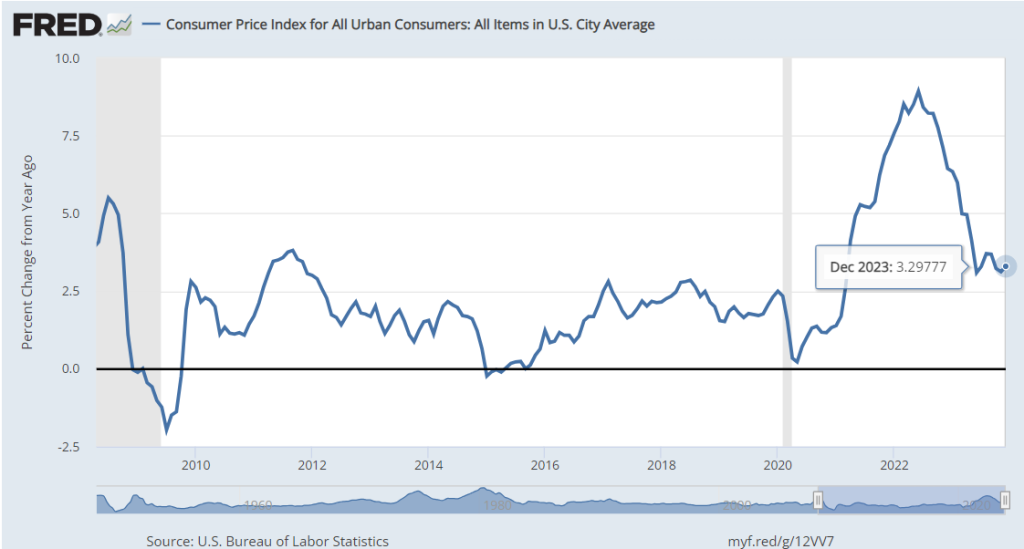

The latest Consumer Price Index (CPI) statistics, released on January 11, 2024, encompass data for December. According to this report, the annual inflation rate for December, prior to any seasonal adjustments, stood at 3.4%. This indicates that from December 2022 to December 2023, the average cost of a selection of goods and services in the U.S. rose by 3.4%. This figure is a slight increase compared to the unadjusted November rate, which was 3.1%.

For December, the core CPI, which excludes the volatile prices of food and energy, was reported at 3.9%. This is a modest decrease from the November core CPI, which was at 4.0% before seasonal adjustment. It’s noteworthy that these rates are significantly lower than the 40-year peak reached in September 2022, where the 12-month rate until September 2022 hit 6.6%.

How Is CPI Calculated?

The Consumer Price Index (CPI) is determined by monitoring the price variations of a consistent set of goods and services.

To calculate the CPI, the Bureau of Labor Statistics (BLS) gathers price data from a wide array of sources, including approximately 23,000 businesses and service providers across the U.S. Additionally, information regarding rent prices is sourced from around 50,000 landlords and tenants to assess rent cost changes.

This basket of goods and services, which forms the basis of the CPI, encompasses a range of commonly purchased items in the United States. The significance of each item in the basket is in proportion to its sales volume. To calculate the CPI, the present price of this basket is compared with its price in the previous year, and this figure is then multiplied by 100 to yield the percentage change.

Annual CPI = (value of basket in current year / value of basket in prior year) x 100

The calculated CPI is then used to determine the inflation rate.

Inflation Rate = (CPInew – CPIold) / CPIold x 100

How CPI Affects You

CPI numbers may appear somewhat theoretical, but they actually mirror tangible shifts in prices that impact your everyday expenses. The influence of CPI on your financial situation includes:

The CPI shows the buying capacity of your earnings. Inflation causes a rise in prices, leading to a decrease in the value of your money, meaning you can buy less with the same amount of money than before.

As a key economic measure, CPI helps assess the effectiveness of government economic policies. While the Federal Reserve often uses the personal consumption expenditures price index (PCE) for inflation, it also considers CPI. Notably, the Fed has been increasing interest rates in response to high inflation.

The federal government utilizes the CPI’s inflation rate to update payment amounts for programs such as Social Security, food assistance, and school lunch schemes. Additionally, it uses CPI to modify the income thresholds for eligibility in various social programs.

Companies often refer to CPI data when determining annual wage increases. This CPI information is a dependable guide for aligning salaries and prices with those of competitors.

Limitations of the CPI

While the CPI is commonly utilized to assess the economic wellbeing, it has its limitations regarding its scope and representation.

One key limitation is that the CPI only tracks inflation for urban populations in the U.S., excluding the inflation experiences of those in rural areas. It also lacks detailed estimates on how different groups, such as the elderly or those in poverty, are affected by inflation. This generalization can lead to monetary policies that do not fully address the diverse needs of these various demographics.

Additionally, the CPI may inaccurately represent the true change in cost of living due to what is known as substitution bias. For instance, if the CPI records a significant rise in the price of a certain product, it doesn’t consider consumers switching to a less expensive alternative. This omission leads to an assumption that people continue purchasing the pricier item, potentially overstating the actual rate of inflation they are experiencing.

Why Is CPI Important?

The Consumer Price Index (CPI) serves as a vital instrument for highlighting fluctuations in the prices of goods and services over time. The official rate of inflation is derived from the changes in the CPI during a specified timeframe.

Although CPI might appear as complex economic information, it has significant implications for consumers. It measures their buying power and influences both the eligibility and the amount of payments for various government initiatives.

CPI is a key indicator of the overall economic condition in the U.S., and it stands as the most widely used economic measure to show the extent of price increases or decreases.

Breaking Down the Monthly CPI Report

The CPI report issued monthly encompasses inflation rates for a variety of goods and services and the inflation across different regions in the United States.

Each report begins with a summary that highlights the increase or decrease in inflation for the previous month and the average price changes over the preceding year.

Specific categories that significantly influence the inflation rate are detailed in the report. For instance, in August 2023, a notable rise in gasoline prices significantly contributed to the overall inflation increase.

The report also compares recent data with historical trends, examining both individual indexes and the aggregate inflation rate.

Key sections of the report focus on food and energy prices due to their direct effect on consumers. Following this, it addresses core inflation, which excludes food and energy costs.

Included in the report are several tables detailing the monthly and yearly changes in prices of various goods and services, covering items like meat, vegetables, cleaning products, clothing, vehicles, housing rents, and healthcare costs.

It’s also important to recognize the inclusion of seasonally adjusted data in the CPI. While this aspect might not be the primary focus in media coverage, it reveals essential short-term price movement trends by removing periodic influences on prices, such as increased airfare costs during the peak summer travel season.

CPI And Inflation on Our Daily Lives

Ah Hock, a kiasu uncle, always prided himself on his ability to stretch a dollar at the wet market. But lately, he noticed his regular $50 no longer filled his market trolley. “Wah, last year, $50 can buy enough kailan to start a farm, but now can barely get a few bunches,” he grumbled. One day, while sipping his kopi-o at the kopitiam, he overheard a conversation about the Consumer Price Index (CPI) rising. “Aiyo, CPI up means my kopi also up, is it?” he wondered. Suddenly, it clicked – the CPI was like his weekly game of mahjong; as the points (or prices) go up, his winning streak (or purchasing power) goes down. Shaking his head, Ah Hock chuckled, “Eh, next time must track this CPI like how I track my 4D numbers, can win or not?” The mix of humor and local flavor in Ah Hock’s realization about the CPI’s impact on his daily life made a complex economic concept surprisingly relatable and a bit amusing for his fellow Singaporeans.

This article was written by:

Benjamin the Bull

I write about companies that fascinate me and that also offers investors with potential as a long-term position. I primarily focus on the energy and industrial sector but every now and again venture out to other sectors too.

Bull Bear Vector’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Bullbearvector as a whole. Bullbearvector is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body