Real estate investment is a powerful wealth-building strategy that offers both financial stability and potential for substantial returns. Whether you’re a seasoned investor or a beginner exploring investment options, this comprehensive guide will equip you with the knowledge and tools to navigate the world of real estate investing successfully.

Understanding Real Estate Investment:

Real estate offers diverse investment avenues, including residential properties, commercial buildings, industrial spaces, and more. Each type comes with unique opportunities and challenges, catering to different investment strategies and risk preferences.

Real estate investment provides multiple benefits, such as rental income, property appreciation, tax advantages, and portfolio diversification. Real estate assets can act as a hedge against inflation and offer stability during economic downturns.

While real estate can be lucrative, it also involves risks like property market fluctuations, unexpected expenses, and tenant-related issues. Successful real estate investing requires thorough research and a proactive approach to risk management.

Setting Investment Goals and Strategy:

Defining Your Investment Objectives:

Clarify your investment goals—whether it’s generating passive income, capital appreciation, or both. Your objectives will guide your investment strategy and help you make informed decisions.

Choosing a Real Estate Investment Strategy:

Choose between strategies like rental properties, fix-and-flip projects, wholesaling, or real estate investment trusts (REITs). Each strategy has its own requirements, returns, and timeframes.

Identifying Your Risk Tolerance:

Assess your risk tolerance by considering your financial situation, investment goals, and comfort level with risk. Different real estate strategies come with varying levels of risk, so choose one that aligns with your risk tolerance.

Setting Investment Goals and Strategy:

-

Defining Your Investment Objectives:

Clarify your investment goals—whether it's generating passive income, capital appreciation, or both. Your objectives will guide your investment strategy and help you make informed decisions. -

Choosing a Real Estate Investment Strategy:

Choose between strategies like rental properties, fix-and-flip projects, wholesaling, or real estate investment trusts (REITs). Each strategy has its own requirements, returns, and timeframes. -

Identifying Your Risk Tolerance:

Assess your risk tolerance by considering your financial situation, investment goals, and comfort level with risk. Different real estate strategies come with varying levels of risk, so choose one that aligns with your risk tolerance.

Types of Real Estate Investments:

Residential Real Estate:

Investing in residential properties, such as single-family homes, multi-family units, and condos, is a popular entry point for beginners. Rental income and potential property appreciation are key benefits.

Commercial Real Estate:

Commercial properties include office buildings, retail spaces, hotels, and more. They offer higher rental income potential but require careful tenant selection and management.

Raw land:

This type of investment involves buying and holding undeveloped land that has the potential for future development or use. Raw land can offer low initial costs and high appreciation in value if the land is located in a desirable area or has a favorable zoning. However, it also involves high uncertainty, taxes, and holding costs, and it may take a long time to realize any profits.

Special use:

This type of investment involves buying and owning properties that have a unique or specific use, such as schools, churches, hospitals, golf courses, and amusement parks. Special use real estate can offer niche opportunities and tax benefits, but it also involves high barriers to entry, limited demand, and regulatory challenges

If you want to learn more about the different types of real estate investments, you can check out these websites:

Property Selection and Due Diligence:

Conducting Thorough Property Inspections:

Inspect properties to identify potential issues, needed repairs, and renovation costs. Hiring professionals for inspections can uncover hidden problems.

Evaluating Property Location and Neighborhood:

Property location significantly affects its rental income potential and appreciation. Consider proximity to amenities, schools, public transport, and safety.

Reviewing Property History and Legalities:

Research property history, title deeds, and any legal encumbrances. Engage legal professionals to ensure a smooth transaction.

Financing Your Real Estate Investments:

Traditional Financing Options (Mortgages):

Mortgages allow you to leverage your investment by financing a portion of the property’s cost. Understand mortgage rates, terms, and eligibility criteria before applying.

Creative Financing Strategies:

Explore strategies like seller financing, private lending, or partnerships to fund your investments creatively when traditional financing is limited.

Assessing Your Budget and Affordability:

Set a budget that considers property acquisition costs, renovation expenses, ongoing maintenance, and property management fees.

Researching Real Estate Markets:

Analyzing Local Market Conditions:

Understand local economic trends, population growth, employment rates, and infrastructure developments that impact property demand and value.

Evaluating Supply and Demand Dynamics:

Assess supply and demand factors for the type of property you’re interested in. A balanced supply-demand ratio can indicate a healthy market.

Identifying Growth and Development Trends:

Research upcoming developments, revitalization projects, and neighborhood improvements that could positively influence property values in the future.

Real Estate Valuation Methods:

A CMA assesses property values based on recent sales of similar properties in the same neighborhood. It provides insights into market trends and comparable prices.

This method values properties based on their potential rental income. It’s often used for commercial and rental properties and considers factors like net operating income and cap rates.

The cost approach estimates the property’s value by calculating the cost to replace it, minus depreciation. It’s commonly used for new or unique properties.

Creating a Real Estate Investment Portfolio:

-

Diversification Strategies:

Diversify your real estate portfolio by including different property types, locations, and investment strategies. Diversification reduces risk and enhances potential returns.

-

Balancing Risk and Return:

Understand the trade-off between risk and return. Higher-risk strategies may offer greater returns, but they also come with increased volatility.

-

Scaling Your Portfolio Over Time:

As you gain experience and resources, consider scaling your portfolio by acquiring additional properties or exploring new investment strategies.

Real Estate Management and Operations:

Real Estate Management and Operations:

Self-Management vs. Hiring Property Managers:

Decide whether to manage properties yourself or hire a property management company. Property managers handle tenant communication, maintenance, and rent collection.

Tenant Screening and Lease Agreements:

Thoroughly screen potential tenants to ensure reliable rental income. Well-drafted lease agreements protect your interests and outline tenant responsibilities.

Maintenance and Property Upkeep:

Regular property maintenance preserves the property’s value and enhances tenant satisfaction. Budget for routine repairs and unexpected expenses.

Tax Considerations in Real Estate Investment:

Tax Considerations in Real Estate Investment:

Understanding Property Taxes:

Understand local property tax rates and how they impact your investment’s overall expenses. Property taxes can vary based on location and property type.

Tax Benefits of Real Estate Investing:

Real estate investing offers tax advantages, including deductions for mortgage interest, property taxes, depreciation, and operational expenses.

1031 Exchanges and Capital Gains Taxes:

A 1031 exchange allows you to defer capital gains taxes by reinvesting proceeds from the sale of one property into another similar property.

Risk Management and Mitigation:

Dealing with Vacancies and Tenant Turnover:

Vacancies can impact your rental income. Have contingency plans to minimize vacancy periods, such as marketing strategies to attract new tenants.

Contingency Plans for Market Fluctuations:

Market fluctuations are inevitable. Establish contingency plans to weather economic downturns, such as having a reserve fund for unexpected expenses.

Insurance Coverage and Liability Protection:

Insurance coverage, including property insurance and liability insurance, safeguards your investment against unforeseen events and potential lawsuits.

Long-Term Wealth Building with Real Estate:

Leveraging Rental Income for Financial Freedom:

Rental income provides a consistent cash flow that can cover mortgage payments, operational expenses, and contribute to your financial goals.

The Potential of Property Appreciation:

Property appreciation can significantly increase your investment’s value over time, building substantial wealth as property values rise.

Legacy Planning and Estate Management:

Real estate assets can be passed down to future generations, creating a lasting legacy and providing financial security for your heirs.

Collaborating with Professionals:

Real Estate Agents and Brokers:

Experienced real estate professionals can help you find suitable properties, negotiate deals, and navigate local market dynamics.

Real Estate Attorneys:

Legal experts ensure smooth transactions, review contracts, and provide guidance on complex legal matters related to real estate investing.

Financial Advisors and Tax Consultants:

Financial advisors and tax consultants help you create a comprehensive investment plan, optimize tax strategies, and align your investments with your financial goals.

Navigating Real Estate Market Cycles:

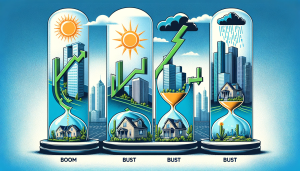

Recognizing Boom and Bust Phases:

Real estate markets go through cycles of growth (boom) and contraction (bust). Being aware of these cycles helps you make strategic investment decisions.

Strategies for Different Market Conditions:

Adjust your strategies based on the current market phase. During a boom, focus on appreciation; during a bust, prioritize stable rental income.

Maintaining a Long-Term Perspective:

Real estate investing rewards patience. Even during market downturns, a long-term perspective can lead to significant returns over time.

Common Mistakes to Avoid:

-

Overleveraging and Excessive Debt:

Avoid taking on too much debt, as it can lead to financial stress and impact your ability to weather market fluctuations.

-

Ignoring Due Diligence:

Thorough due diligence is crucial. Skipping inspections, failing to research market trends, and overlooking property histories can lead to costly mistakes.

-

Neglecting Property Management:

Effective property management is essential for long-term success. Neglecting property upkeep and tenant relations can result in financial setbacks.

Incorporating ESG Principles in Real Estate:

-

Environmental, Social, and Governance Considerations:

ESG principles address the impact of real estate investments on the environment, society, and governance practices. Integrating ESG factors can align your investments with sustainability goals.

-

Sustainable and Responsible Real Estate Investing:

Explore opportunities to invest in energy-efficient properties, support affordable housing initiatives, and contribute positively to the communities you invest in.

Conclusion:

Real estate investment offers a dynamic path to wealth building, providing passive income, property appreciation, and long-term financial security. By understanding the intricacies of different real estate types, markets, and strategies, you can make informed decisions that align with your goals. Remember that successful real estate investing requires diligence, education, and a commitment to long-term growth. As you embark on your real estate investment journey, continue learning, adapting,

Want to learn more? Watch this video!

This article was written by:

Benjamin the Bull

I write about companies that fascinate me and that also offers investors with potential as a long-term position. I primarily focus on the energy and industrial sector but every now and again venture out to other sectors too.

Bull Bear Vector’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Bullbearvector as a whole. Bullbearvector is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body